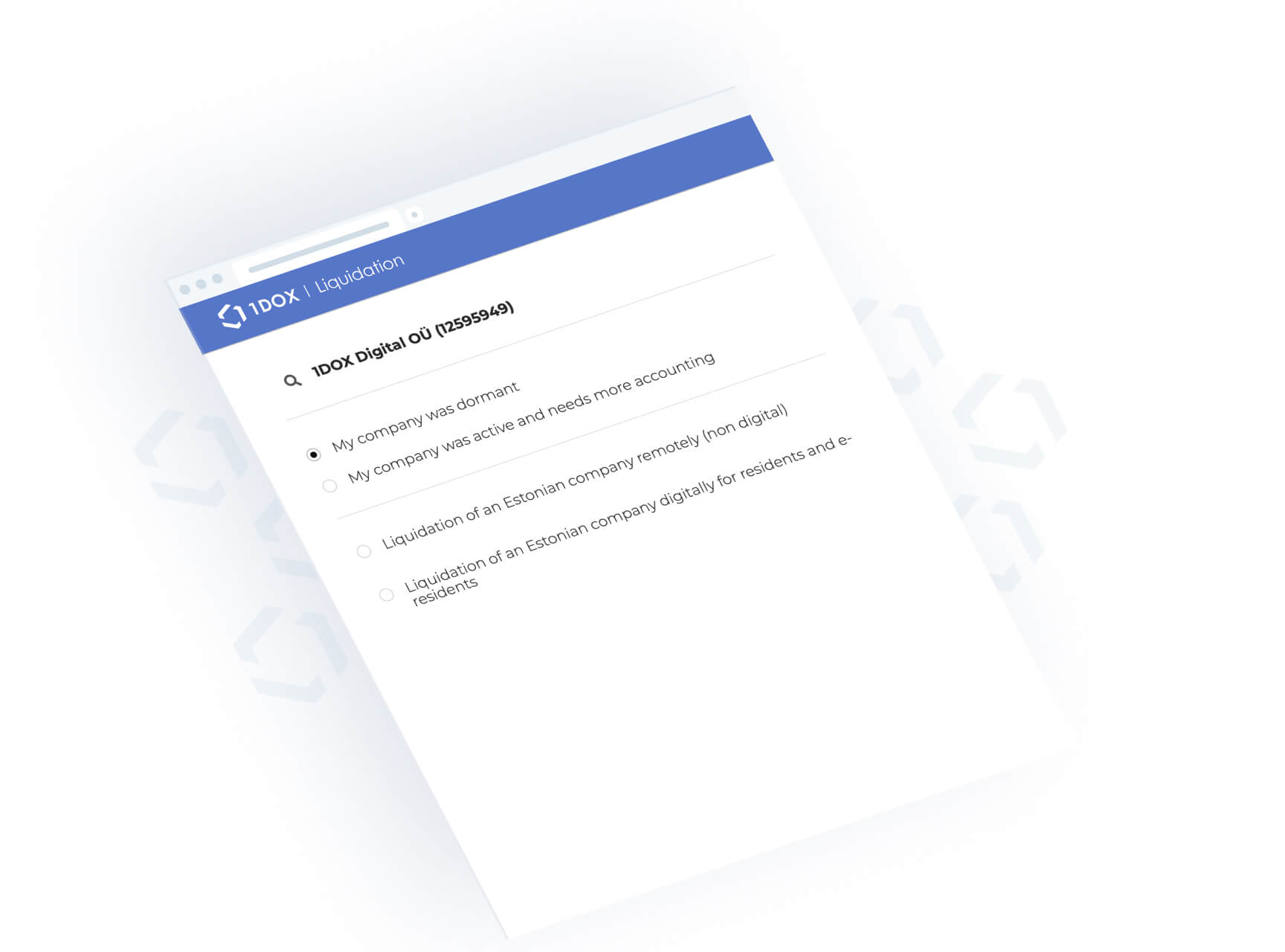

Company Liquidation for e-residents

For e-residents in need of company liquidation

with all accounting reports being completed.

We’ll prepare the liquidation documents, after which you just need to digitally sign them.

This allows us to take care of the rest and your time input will be minimal.

Order liquidation

Who is this service for?

We have created this service for e-residents who do not want to continue business with their company, but would also like the process to be hassle-free.

The liquidation process can be started after all accounting reports are completed and finalized.

How much does it cost?

- Liquidation services and state fees €

- Missing annual reports and liquidation reports according to price offer

+VAT if applicable

Order liquidation

Why choose our liquidation portal?

The liquidation process takes at least 7 months and a local liquidator is needed.

Liquidators often lose control over the process as they cannot remember how, when and what to do next.

The 1DOX portal will solve these problems.

How it works

Create an order and identify yourself with PIN1

Upload accounting documents (if there are any)

Confirm the price offer and pay

Grant the accountant access for preparing the annual report in e-Business register

Confirm and sign the annual report(s)

Sign the liquidation decision and related documents

Sign the liquidation petition in e-Business register

Sign the prepared liquidation report in e-Business register

Sign the final balance and asset allocation plan

7 months after the public announcement the local liquidator will sign the petition for final deletion of the company

Your company will be then deleted usually in a few working days

Good to know

This service can be used only if:

- The current board member who will also be one of the liquidators is capable of digital signing

- Before registering the liquidation and liquidators the company’s balance sheet must be emptied, all previous accounting reports must be submitted and liquidation balance and final balance drafts must be prepared.

You can fix all accounting matters here: In case you need assistance with accounting matters:

If any of the shareholders are not capable of signing the documents digitally according to the requirements an additional cost will apply

100 EUR/person + VAT if applicable

If the service provider is given falseful information (for example but not limited to, a company has had hidden before or a board member is not capable of signing digitally), the service provider has the right to ask for an additional fee if the service provider sees a possibility to liquidate the company under the new circumstances.

In case the service provider determines that it is no longer possible to complete the process under the new circumstances then the service provider has the right to terminate the services without returning funds to the client.

Clean your web image and reduce stress

An inactive company is a burden for your online image

Creating a new company is very easy, but there is no need to keep the company ready just in case.

Nowadays, it is far better to eliminate all online connections you do not need.

Get rid of the hassle of annual reporting

Even inactive companies need to submit reports every year.

If you miss the reporting deadlines, you will receive negative statements online. A missing annual report might even result in a penalty. You can avoid this by liquidating your inactive company altogether.