Liquidation via merger

This option is only available for 1-man companies.

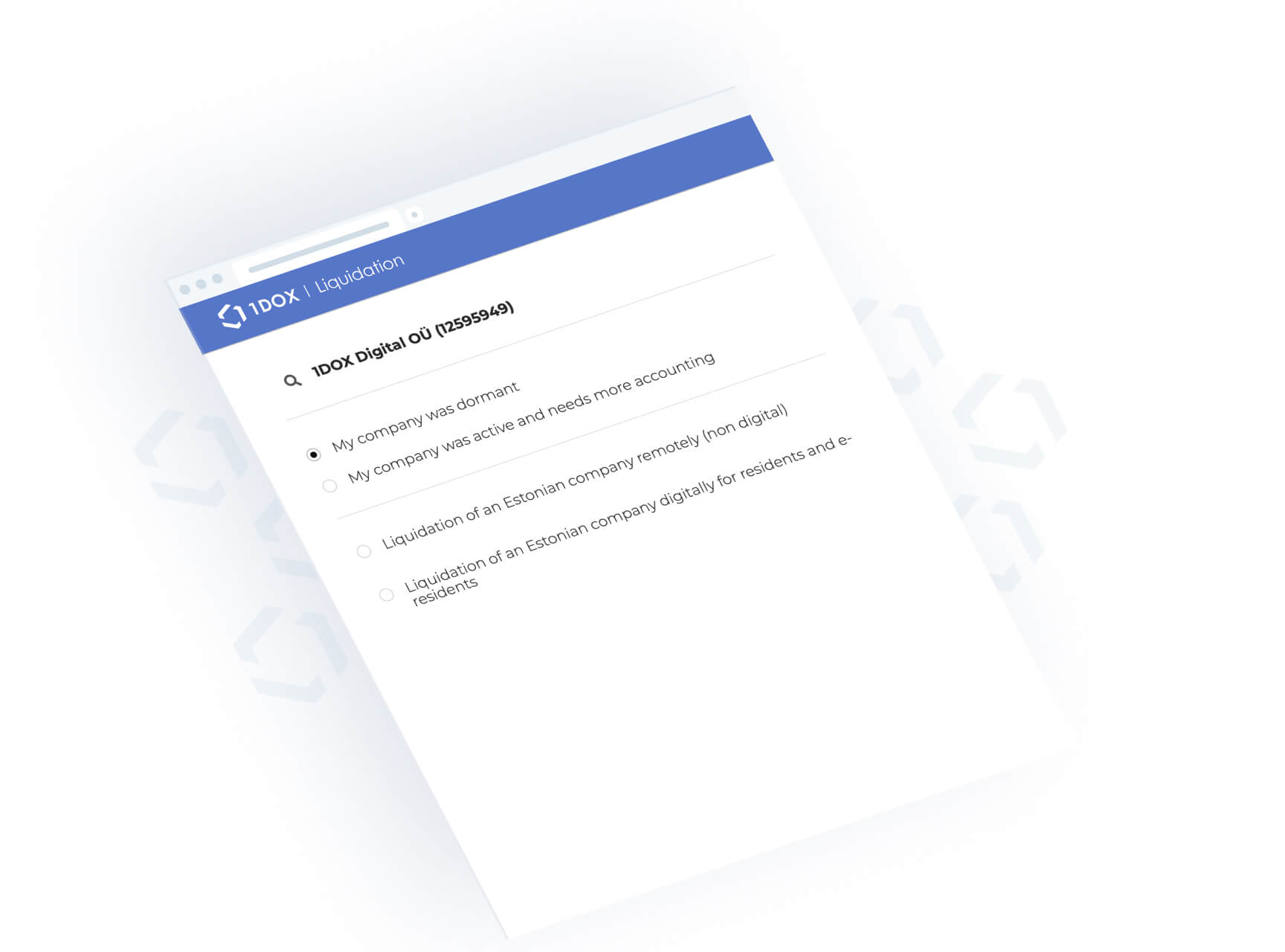

- Wherever you reside, we will guide you along the liquidation process

- 1DOX will take care of the process after you have sent us the required documents. You will be free from this point on!

This is not only available but also the preferred option for 1-man companies.

Order liquidation

Who is this service for?

This service is meant for all 1-man companies who wish to liquidate the company quicker than the traditional way.

Company liquidation via merger enables a company to be liquidated in a simplified manner by transferring the company’s assets to a natural person who is the sole shareholder, as a result he/she will then become the legal successor of the company.

How much does it cost?

- Liquidation services and state fees 1475€

- Accounting costs based on offer (if needed)

+ VAT if applicable

Order liquidation

Why use the 1DOX liquidation portal?

Our dedicated experts combined with our great tools are all here to help you make the process of liquidation less stressful and time-consuming.

1DOX has made over 40 liquidations via mergers. All of these have been a success and without any delays.

1DOX helps you keep your online image nice and neat!

An inactive company is a burden for your online image

Creating a new company is very easy, but there is no need to keep the company ready just in case.

Nowadays, it is far better to eliminate all online connections you do not need.

Minimize the hassle of annual reporting

Even inactive companies need to submit reports every year.

If you miss the reporting deadlines, you will receive negative statements online. A missing annual report might even result in a penalty. You can avoid this by liquidating your inactive company altogether.