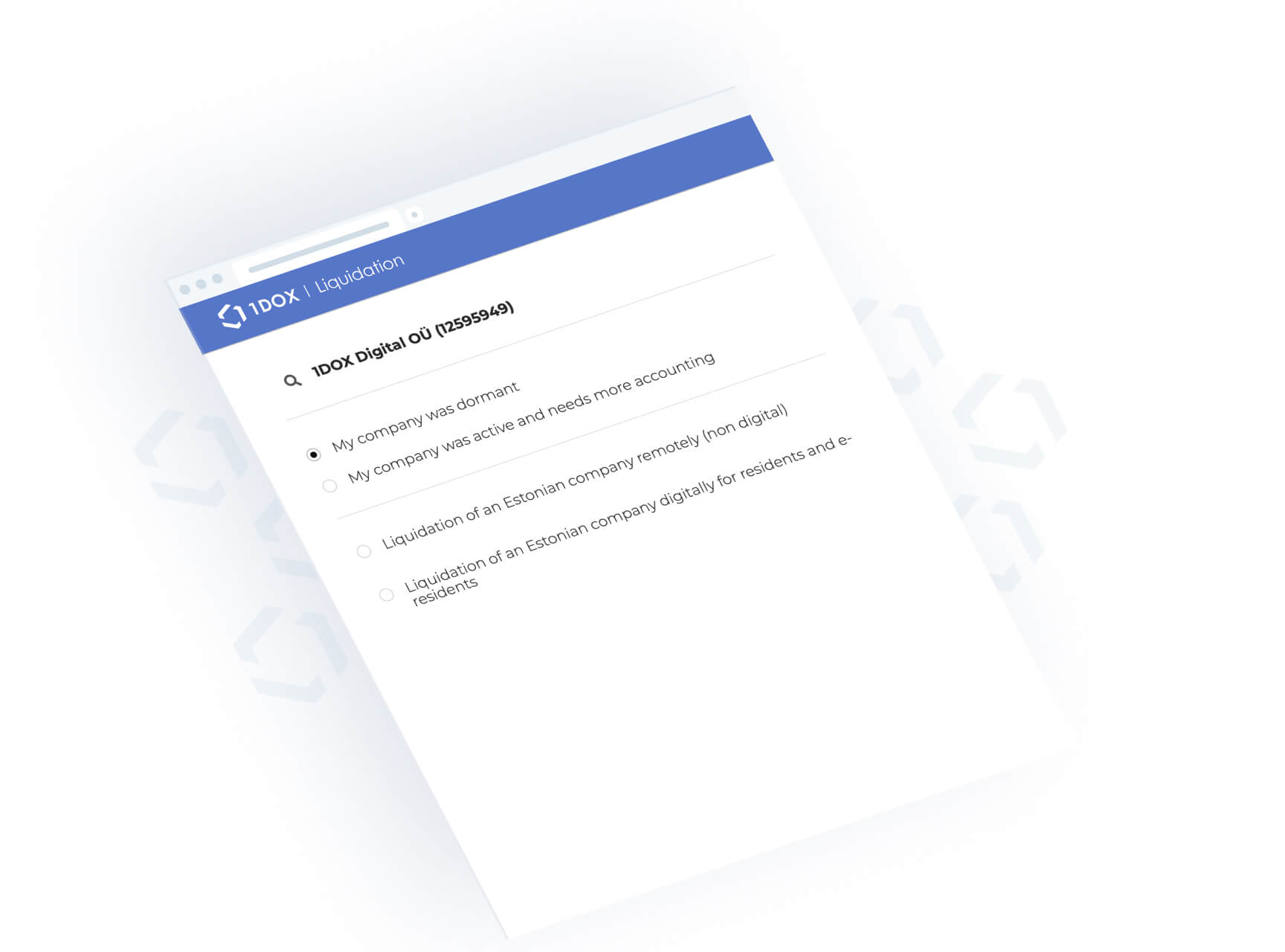

Liquidation of Dormant Company

Estonian company liquidation service

- We prepare the deletion decision

- We will prepare the deletion petition in the Business Registry

- We collect signatures and submit a petition

- The deletion notice will be published in official announcements

- After 3 months, the company can be permanently deleted

Order liquidation

Who can use this service?

This service is tailored for those who have a fully dormant Estonian company.

For e-residents, this process is quite easy and does not need much of your time.

If you can’t sign digitally (with e-residency), you must sign some documents by the local notary and apostill them. We will prepare the documents and guide you.

NB! If your company has received any fines from the Business Register, e.g. for not submitting an annual report, then it cannot be considered as an inactive (dormant) company any longer, as the relevant fine(s) must be included in the declarations submitted to the Tax Board. In this case, you should not choose the dormant company liquidation option.

How does it work?

Send us liquidation query

Answer clarifying questions if they arise

Pay the service fee

Sign the prepared deletion decision and petition

3 month waiting period

Now the company can be deleted permanently

How much does it cost?

- Dormant company liquidation for e-residents 400 €

- Dormant company liquidation for non-e-residents 800 €

- Missing annual reports (if we need to do additional reporting) 100 € /report

+ VAT if applicable

Order liquidation

Why to choose our liquidation portal?

The 1DOX portal prepares the documents needed for liquidation and guides you throughout the entire process.

Good to know!

This service can be used only if:

- The company is fully dormant – having no transactions which should be booked in accounts and no penalties from the state.

For non-e-resident companies, the price is valid for 1 man company. If more people are involved – ask for price offer.

Clean your web image and reduce stress

An inactive company is a burden for your online image

Creating a new company is very easy, but there is no need to keep the company ready just in case.

Nowadays, it is far better to eliminate all online connections you do not need.

Get rid of the hassle of annual reporting

Even inactive companies need to submit reports every year.

If you miss reporting deadlines, you will receive negative statements online. A missing annual report might even result in a penalty. You can avoid this by liquidating your inactive company altogether.